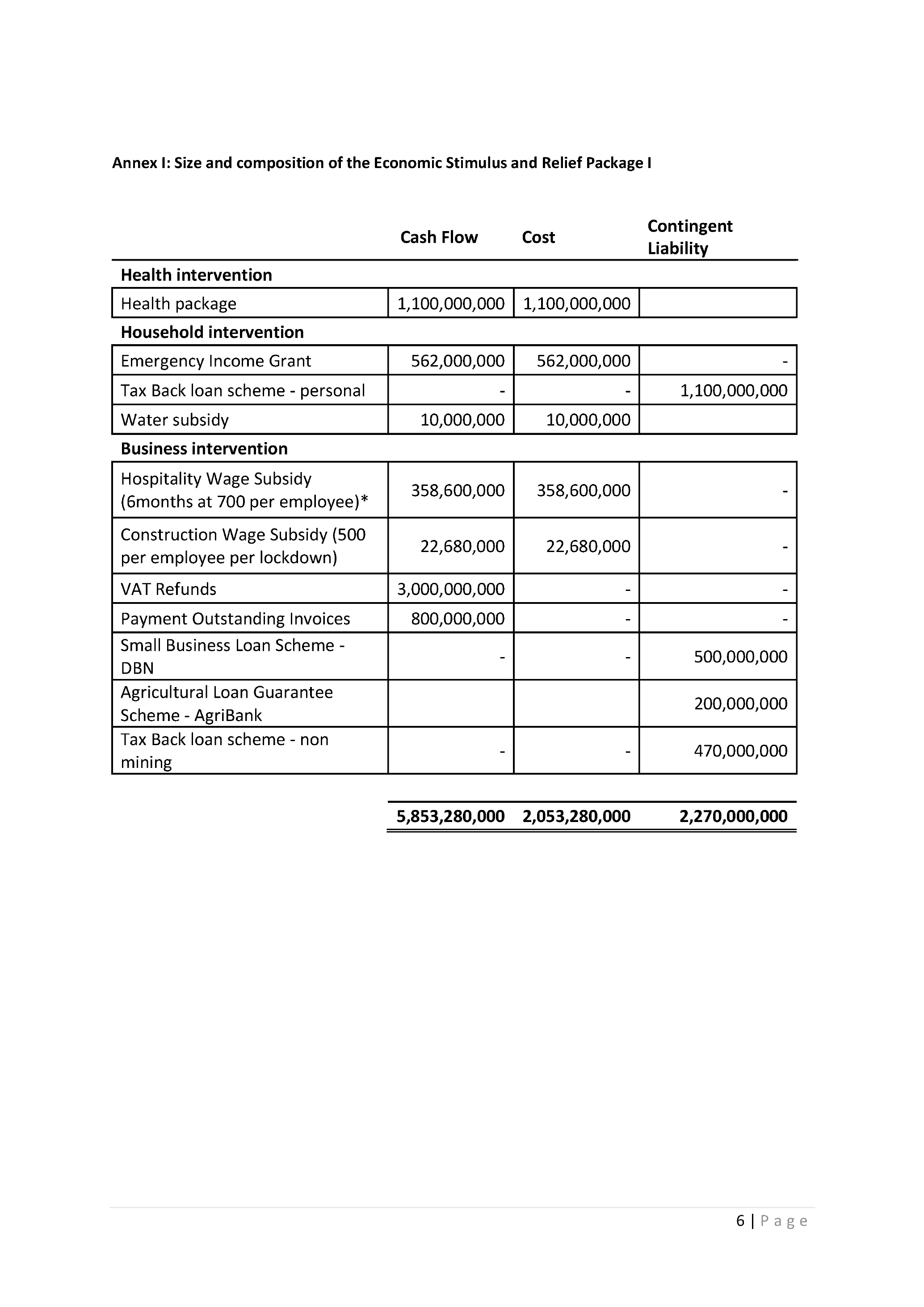

(g) Tax-back loan scheme for non-mining corporates. To provide

breathing room for cashflow-constrained businesses in the non-mining

sectors who are taxpayers, such businesses can borrow an amount equal

to 1/12" of their tax payment in the previous tax year, to be repaid after

one year. The interest rate will be favourably low at the prime lending rate

less 1%, on the back of the Government guarantee, capped at N$470.00

million. Applications will be made via the banks.

(h) Relaxation of labour regulations to protect jobs. To avoid major

retrenchments and business closures, employers including Government

and business owners will be allowed to negotiate a temporary 20%

reduction of salaries and wages during the crisis period, and 40% for the

worst-hit industries. The negotiations will be undertaken through a

consultative process with employees and labour unions.

Support to households

3.2 To support the households cope with reduced income, increased health

related spending and other hardships due to the virus outbreak, the following

measures are proposed:-

(a) An Emergency Income Grant, to support those employees who have lost

their jobs due to the pandemic and its fallout. This is a once-off payment

of N$750 to people who have lost their jobs, either in the informal or in the

formal sector, essentially to stave off the vulnerabilities which arise.

Applications may be made by Namibians citizens between 18 and 60

years of age who have lost their jobs and not receiving any other social

grants. Payment will be made by Government in collaboration with the

Social Security Commission within 7 days utilising the banking sector's

ATM infrastructure. The total amount for this measure is costed at a

maximum of N$562.00 million, based on the national poverty line of about

N$250.00 per person per week.

(b) Tax-back loan scheme for tax registered and tax paying (PAYE)

employees and self-employed individual persons who have lost

income or part thereof. To provide breathing room for cashflow-

constrained individuals who are taxpayers, they can borrow an amount

equal to 1/12" of their tax payment in the previous tax year, to be repaid

after one year. The interest rate will be favourably low at the prime lending

rate less 1% on the back of a Government guarantee. The total guarantee

is capped at the maximum of N$1.1 billion, based on the PAYE tax register

and the potential loan size. The Government, in collaboration with the

banking institutions may institute statutory and administrative measures to

enhance compliance with loan obligations.

(c) Water subsidy during lockdowns. Government will ensure that water

points are kept open without a need for water cards during lockdowns,

through NamWater and Local Authorities that will subsidize this critical

4|